FAQ

Here you can find answers to your questions.

-

How to start working with BetaTransfer Kassa?

You apply to us through any of our contact channels, discuss details of your business and your wishes with our managers for your consumer payment solutions.

2. Create an account on our platform https://merchant.betatransfer.io/.

3. Get API keys for automatic work with your site in the personal cabinet.

4. Connect our API to your store, and that’s all, you can work taking payments from your customers through us.

-

How soon you can start accepting payments?

On average, the connection process takes 3 days. We understand how important for the client to be connected as quickly as possible and we try to do it as quickly as possible for your convenience.

-

What methods of receiving funds can you provide?

Our main service is to accept money from bank cards of your payers. Additionally, we can consider variants of reception of means in e-wallets, cryptocurrency: BTC, ETH, USDT(erc20/trc20).

-

What countries for receiving funds can you serve?

Almost the whole world: Asia, the EU, the countries of the former CIS and even Australia.

-

What is strictly forbidden to do, and what can lead to a complete breakdown of cooperation?

As cliché as it sounds, we ask our clients not to lie. We have been accepting payments for a long time, including in the High Risk area, and believe us there is not much that could surprise us. We ask you to communicate clearly and understandably your line of business and the type of financial traffic you need to process in high risk credit card processing companies. The worst thing is when one site is claimed and replenished by third-party sites and 2d payment sites. In this case, we can hold funds for a long period and stop any further cooperation, so we ask our customers not to do this.

-

In what currencies can you organize the reception of funds?

Reception is possible in currencies: USD, EUR, UAH, KZT and other. The processing currency: USD, EUR and other. But it’s worth mentioning that the invoice can be issued in any currency of the world (depending on your needs in receiving payments). The bank will convert currencies if necessary.

-

Do you use rolling reserve?

It means freezing 5-10% of your incoming money for 30-180 days. We are very flexible in terms of rolling reserve, and this is one of our main advantages. Whether rolling will be applied in your case depends on the requirements of the bank and in which country you work. Often we don’t assign rolling.

-

What does the BetaTransfer payment page look like?

Our payment form looks like this :

-

What languages can the form of acceptance of funds from a bank card be displayed in?

In what languages can the form of reception of means from a bank card be displayed?

The fund’s acceptance form is in Russian, Ukrainian and English.

-

Do I need a legal entity to join you?

We discuss this issue individually with each client. If you have a registered foreign company, this will be a plus and will speed up the connection to payment solutions.

P.S.

If you find it hard to set up a company we can take care of it and make you a company in England in a few days. That, in turn, as well will bring better reputational liquidity for your project.

-

How long does it take to withdraw funds?

Withdrawal speed depends on the bank to which your site is connected and takes from 1 minute to 24 hours. All withdrawal transactions are closed in a maximum of 24-48 hours.

-

How does payment acceptance from bank cards Visa, Mastercard, etc. look like?

Acceptance of credit card payments will look differently, depending on which gateway you will have :

-

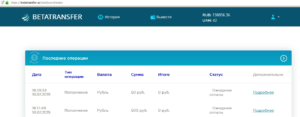

What will I see inside my personal account of Betatransfer Kassa system?

Here you will see your current balance, all transactions with their respective states, and possible withdrawal options:

-

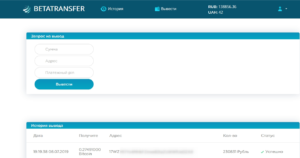

How can I withdraw funds?

The main most popular withdrawal is in BTC, ETH, USDT(erc20/trc20), or withdrawal to bank cards. Also, from available options among payment web services. Withdrawal of funds is requested in the personal office of the user as follows:

-

What is the % for your services?

The percentage for our services largely depends on the subject of your business, as well as the banking gateway on which your project is approved. You can accept credit cards payments on website. The approximate percentage can be stated as follows: the percentage of input of funds from bank cards from 8%, the percentage of withdrawal of funds from 2% and above, depending on the desired withdrawal currency.

-

Do you have holdings? How often can I withdraw?

We don’t have holdings. You can make a withdrawal even several times a day.

In some cases, a hold of funds for 24-48 hours can be individually assigned. It depends on the requirements of the bank and on which country you work in.